BIG NEWS

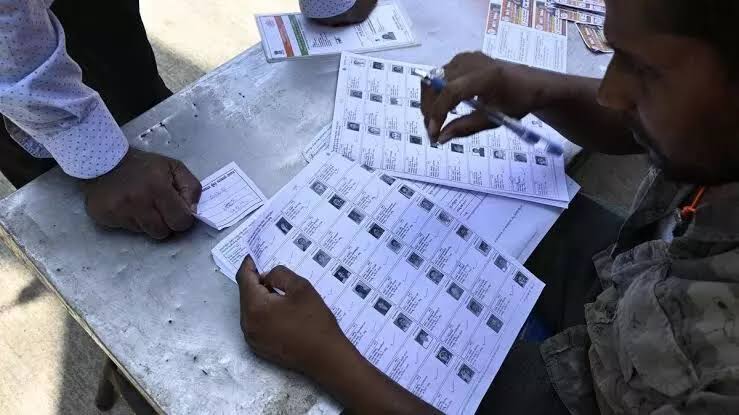

- EC says over 70.69 lakh inclusion claims, 2.68 lakh deletion requests in UP SIR exercise

- Mamata Banerjee continues sit-in against SIR voter deletions for second consecutive day

- Dera Sacha Sauda chief Ram Rahim acquitted in 2002 journalist murder case

- Domestic LPG hiked by Rs 60, commercial cylinders by Rs 114.5 amid global energy surge

- Punjab and Haryana High Court acquits Dera chief Ram Rahim Singh in 2002 journalist murder case

- India a match away from T20 World Cup after beating England in nail-biting semi-final

- Trump fires Homeland Security Secretary Noem after building criticism over immigration enforcement

- R N Ravi named West Bengal governor as Prez effects major reshuffle of gubernatorial posts

- CV Ananda Bose resigns as Bengal Governor; RN Ravi to replace

- After calling US-Israel strikes illegal, Canada’s Carney won’t rule out role in Iran war

Government to levy additional excise duty on tobacco, health cess on pan masala from February 1

Public Lokpal

January 01, 2026

Government to levy additional excise duty on tobacco, health cess on pan masala from February 1

NEW DELHI: The government has notified February 1 as the date from which additional excise duty on tobacco products, and a health cess on pan masala will be levied.

The new levies on tobacco and pan masala will be over and above the GST rate, and will replace the compensation cess, which is currently being levied on such 'sin goods'.

From February 1, pan masala, cigarettes, tobacco and similar products will attract a GST rate of 40 per cent, while biris' will attract 18 per cent Goods and Services Tax (GST), according to a government notification.

On top of this, a Health and National Security Cess will be levied on pan masala, while tobacco and related products will attract additional excise duty.

The Finance Ministry on Wednesday also notified the Chewing Tobacco, Jarda Scented Tobacco and Gutkha Packing Machines (Capacity Determination and Collection of Duty) Rules, 2026.

In December, Parliament approved two Bills that allow the levy of the new Health and National Security Cess on pan masala manufacturing and the excise duty on tobacco.

The government on Wednesday notified February 1 as the implementation date for these levies.

The current GST compensation cess, levied at varying rates, will cease to exist effective February 1.

PTI